Transforming management reporting in the digital era through dashboards to make better decisions based on connected, traceable and comparable data

As the pace of business relentlessly increases in today’s corporate world, financial executives are under constant pressure to close faster, report earlier and produce insightful business reports for investors, shareholders and boards in order to make better decisions aimed at gaining market share and creating added value.

Amid fierce competition, the quality of financial reporting cannot be compromised by disconnected data and unforeseen events. Therefore, traditional reporting techniques and spreadsheets must give way to new financial analysis tools and accurate predictive models in order to make insight-driven decisions and spot trends that would otherwise go unnoticed.

However, this might seem a tall order considering the complicated financial reporting requirements, regulatory oversight and compliance, size and diversity of operating units, tight deadlines and constantly changing technology.

To help organizations rise to this challenge, everis accompanies them in every step of their finance transformation, jointly defining and implementing an analytical and reporting model tailored to the needs of their business and scalable to both present and future requirements.

The importance of connected data

But in today’s connected world, globally distributed enterprises are faced with yet another challenge, that of shifting from decentralized work models and disparate datasets to connecting and leveraging their data to generate actionable business insights. Therefore, they need a solution that will enable them to work more efficiently as a unified operation.

How can everis help them to achieve this?

We know that the value of reporting is its relevance and support for the decision-making process, since good insight gained from real-time access to connected data will help organizations make the right decisions in a timely manner. Hence the importance of building a robust financial and management analysis and reporting layer on top of harmonized data sources to ensure maximum traceability and comparability.

Proven methodology

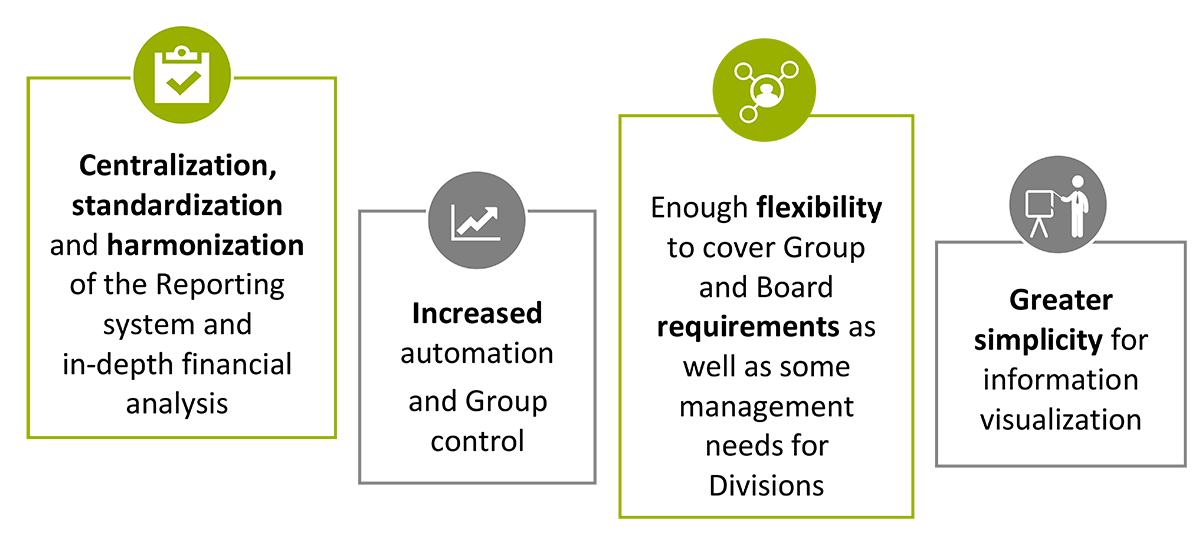

We are aware that no two organizations are alike and that requirements vary widely from one client to another. everis caters for all of them by designing customized solutions built on the technologies that will help them to advance in their finance transformation needs quickly, efficiently and effectively to achieve:

- Greater business visibility. Ensuring the availability of connected, traceable and comparable data across the organization.

- Better decision-making. Understanding the Cost and Profitability structure to make better decisions and proactively manage the business.

- Standardization. Harmonized, shared data at all levels of the organization.

When addressing the transformation of the reporting and analysis model, we must firstly identify the consumers of the information, how it will be used and the type of decisions it will drive.

These factors are key to discriminating relevant information, determining how it will be displayed, the frequency with which the information will be supplied, whether real or near-real time information is required, if the reports will be static or have navigation or self-service options, the level of aggregation or granularity required, and the medium or channel through which it is placed at the consumer’s disposal.

This will allow us to effectively adapt the type of information and analysis to the different internal/external shareholders and to each business unit and level.

In order to adequately identify our clients’ analysis and reporting needs and evaluate their current product costing models, everis proposes a participatory approach based on work sessions consisting of specifically targeted workshops where we will break down and analyze the components of analytical models, the reporting process, and structure and analysis of profitability statements, in addition to visiting manufacturing plants to analyze production processes, data capture methods and workflow.

We will jointly define the analytical model and management reporting model at board, group, business unit or plant level, which will be fully integrated to ensure the maximum level of granularity, in addition to the key business variables and profitability analysis hierarchies that will allow us to gain a relevant perspective on the state of the organization.

Beyond business unit performance, the new context requires visibility and understanding of profit and value drivers such as markets, customers, product families, commercialization geographies, channels, production units or new investment projects.

The transformation and deployment of these new analytical capabilities on a robust technology base enables Real-Time Decision-Making on:

- How to grow business and market share.

- Developing or discontinuing activities.

- Optimizing the product portfolio or sales channels.

- Efficient and effective customer life cycle management.

- Maximizing ROI.

Case Study

A leading manufacturing company with high geographical dispersion and a decentralized organizational model faced with the challenge of building a user-friendly analysis and reporting system that will provide users with a common basis for informed decision-making to reduce the probability of errors and increase financial control by:

- Establishing a standard Analytical Model.

- Improving the Reporting system at group, company, board and manufacturing plant level.

- Standardizing management report structure and format.

- Providing reliable and comparable information for decision-making at all levels.

- Streamlining the data gathering processes.

- Ensuring data quality.

- Reducing lead time.

- Achieving data traceability.

Achievements

- Solutions. Comprehensive Analytics offering.

- Team. Analytics team of 150+ highly qualified and certified professionals, including financial experts, digital transformation controllers, scenario modelers and data specialists.

- Proven Results. Extensive experience in Cloud and onsite analysis solutions.

- Resources. Methodology, alliances, lab simulations, discovery sessions.

- Innovation Center. 16+ years of continuous growth in Business Analytics (eM, CDAC, eDIC, Co-Investment).

- Technology. Business Intelligence, Artificial Intelligence, Big Data, Advanced Cognitive Applications, RPA, Analytics programming languages (Phyton, R, etc.).

- Global. everis is a NTT Data Company, with 110,000+ professionals in 50+ countries and an annual revenue of US$ 16 billion.