everis helps organizations rethink their operating model to aid the decision-making process and transform strategic intent into results by bridging the gap between the finance function and the business strategy

Looking ahead, continuous market changes spearheaded by digital technologies, advances in artificial intelligence and robotics in the last few years clearly show that organizations must be prepared for surprises and be ready to move in directions that are often difficult to predict. This scenario not only requires defining an operating model adaptable to this rapid pace of change, but also aligning it to the business strategy in order to meet these future challenges.

With organizations in a constant state of flux, this alignment is critical. Therefore, operating models must continually evolve to accommodate new and innovative business models arising from disruptive technology strategies that require more agile ways of working to address risk and seize new opportunities.

Not surprisingly, Finance is facing growing pressure to pioneer this evolution by effectively aligning investment in new technologies with the business strategy and core finance function to drive finance transformation. The changing market dynamics and forces have pushed finance executives to shift their focus from number crunching to reshaping the finance function. This involves taking on a more strategic role as business planners and technology evangelists, looking beyond traditional financial reporting and responding faster to the increasingly complex market reality marked by rapid change and higher volatility on a global scale. As a result, organizations are realigning talent in finance teams to new priorities, evolving their traditional role to one of business partnering.

Therefore, redefining the operating model cannot be taken lightly, but rather requires change across the organization to translate strategic intent into tangible results by providing a clear direction.

Bridging the gap between finance and strategy

An operating model is a high-level visual representation of how an organization does business and delivers value to its internal and external customers today (“As Is”) and how it will work in the future (“To Be”). Organizations use operating models as a tool to help them formulate and execute their business strategy. They are essentially a blueprint for achieving their objectives and meeting future challenges.

At everis we know that implementing a well-defined and articulated operating model that will aid the decision-making process to achieve the organization’s strategic objectives is paramount to address this business transformation and avoid the risk of misalignment.

Redefining the operating model requires transformation at organizational, process and technology level through a cross-functional approach that affords a wide-angle view of the entire organization, including people, processes, governance and IT. It involves creating a participatory framework of perfectly defined processes, activities and tasks where each role has clearly assigned activities and tasks and aligning them with the business strategy.

Therefore, it is of utmost importance to assess the current situation to:

- Identify and analyze opportunities for improvement.

- Measure the gap between the current operating model and the target operating model to define the necessary changes and establish an implementation and training plan.

- Implement the target operating model by executing the implementation and training plan to guarantee its adoption across the organization.

Case study

- High geographical dispersion.

- Inorganic growth in Spain and lack of a unified operating model.

- Need to streamline processes to continue growing.

- Provide the necessary tools to consolidate themselves among the top 10 industry players.

- Duplication of revenue to become one of the top 10 sector companies in Europe.

Methodological approach

Our specialized team of professionals, experts in digital finance transformation, combined advanced methodologies, facilitation and experience to help the organization achieve its goals using proven methodology:

Phase 1: Discover

- Identification of the core business value drivers and link them to critical capabilities, processes and technology.

- Analysis of the type and complexity of the organization and its expectations moving forward in order to detect opportunities for growth and areas for improvement.

- Selection of the digitalization and automation technology to be implemented with the aim of facilitating the process operability and the decision-making process.

- Definition of metrics and KPIs to measure the degree of efficiency and effectiveness of the different processes that form part of the operating model.

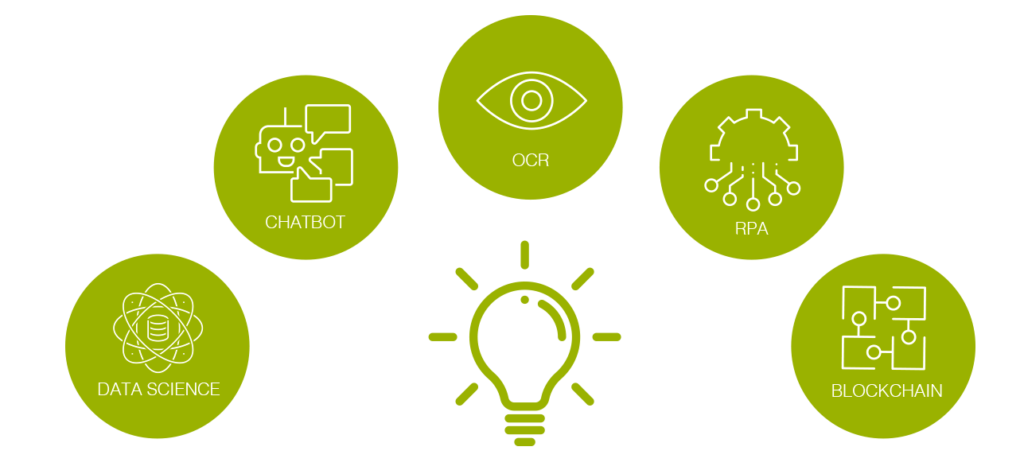

Data Science. Various technologies which, combined, process data, learn from them and act accordingly, imitating the operation of a human brain.

Chatbot. Technology that allows a user to hold a conversation with a computer program.

OCR. Optical character recognition software that facilitates the digitisation and subsequent use of documents.

RPA. Technology developed with the objective of replicating human actions in routine computer processes.

Blockchain: Technology aimed at expediting financial transactions, enabling fast and secure cross-border transactions between banks, guaranteeing transparency and auditability, and improving relations between financial institutions.

Phase 2: Define

- Definition of the target or “To Be” operating model based on the analysis carried out in the first phase.

- Definition and formalization of the processes envisaged in the redefinition.

- Definition and formalization of the activities and tasks of each process, the person(s) responsible for the process, timing and inputs/outputs of the process in the target operating model, with sufficient granularity.

- Definition and formalization of the metrics and KPIs that will serve to value the processes in terms of effectiveness, efficiency, usefulness and guarantee.

- Definition and formalization of the necessary changes in technological tools to support the newly defined processes and calculate the metrics and KPIs.

- Definition of a plan for implementing the target operating model.

- Process training and dissemination plan.

Phase 3: Design

- Establishment of the design requirements and principles that were translated into an actionable road map, including all the intermediate processes for building the “To Be” model defined in the second phase.

- Execution of the plan for implementing the target operating model.

- Accompaniment in the organizational change process, focusing efforts on the disclosure and measurement of metrics, and monitoring and reporting on the effectiveness and efficiency of the new operating model.

- Accompaniment in the verification and approval of the fulfillment of the adaptations implemented in the tool with the defined requirements.

- Establishment of the ongoing improvement process of the new operating model.

Technology implemented

The organization’s core technology was based on its ERP (JD Edwards). However, after the initial evaluation and benchmark established in the first phase, we identified the need for an agile solution that would support business growth while adapting to the situation of the different types of subsidiaries:

- Subsidiaries undergoing consolidation where all the back-office processes are centralized with the ERP and technologies, controlled by the parent.

- Subsidiaries undergoing transition and which may have some centralized processes and technologies, but not necessarily controlled by the parent.

- Subsidiaries undergoing expansion and which are fully independent of the parent and have their own processes and technologies.

Therefore, we proposed deploying JD Edwards to Oracle Cloud to achieve greater:

- Scope. Flexible standards-based scope.

- Predictability. High predictability of development, service and maintenance costs based on usage.

- Efficiency. Exponential improvement of operating process efficiency.

- Success. Measurable guarantees of success.

- ROI. High return on investment.

- Cashflow. Maximization of effective cashflows.

- Savings. On increased efficiency.

- Agility. Quick response to changes without IT bottlenecks that could lead to disruption of day-to-day operations.

Benefits

- Unified operating model aligned with the business strategy to aid the decision-making process and achieve strategic business objectives.

- Definition and implementation of a strategic road map of change to guarantee ongoing improvement.

- Harmonized accounting processes, improved cash management model and installation of budgeting and consolidation tools.

- Improved ERP model, with support for business growth, greater business agility, lower cost and risk reduction.