The current COVID-19 situation is highly volatile and its evolution will depend on a wide range of medical, social, legal, political and economical variables. Recent developments have placed companies to focus on ensuring viability and revamp of their business and ecosystem of vendors, customers, CFOs are leading Finance teams to contribute by focusing on Business continuity, Talent management, Leadership and Digitalization.

On the Digitalization front, we observe that process digitalization is now a must rather than a wish or a trend. Companies are adapting their processes not only to external customers according to geography, demography and health but also to internal requests, such as work-life balance and finance professionals career development.

By digitalizing finance processes we observe that companies obtain 5 key benefits:

1. Business Disruption risk mitigation

Partnering with a major utilities company on Accounts Payable process.

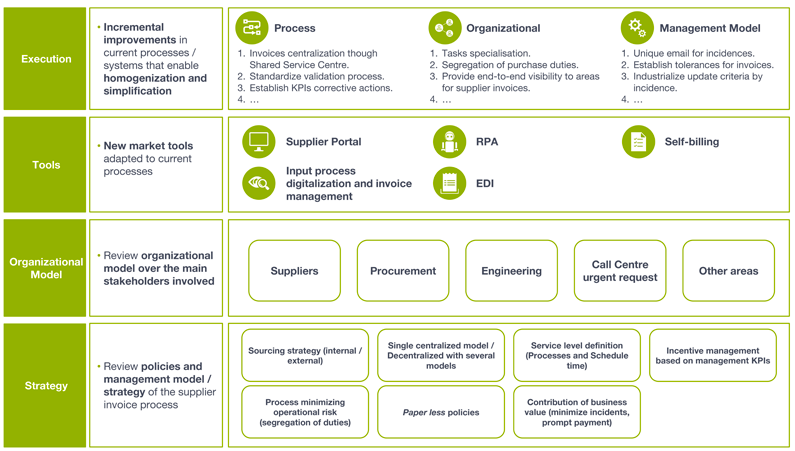

Challenges: Organization working in silos and with manual intervention along the purchase to pay process cycle, generated inefficiencies in invoice recording and payments.

In this industry, lack of compliance on payments policies to public and private companies, prevents companies from accessing to key bidding opportunities.

Purchase to Pay process lack of digitalization was preventing our client to access tendering processes and eroding the ability to meet Mid Term Business Plan.

2. Efficiency in the adaptation to business needs

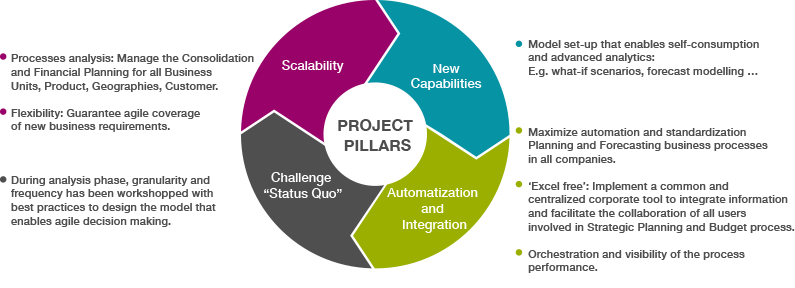

A leading FMCG group with an ambitious growth agenda was experiencing difficulties to drive real-time business insights.

Accelerated inorganic growth generated a landscape of diverting criteria, procedures and processes across business units, prevented benchmarking and analysis.

3. Productivity improvement maximizing employees value to the organization

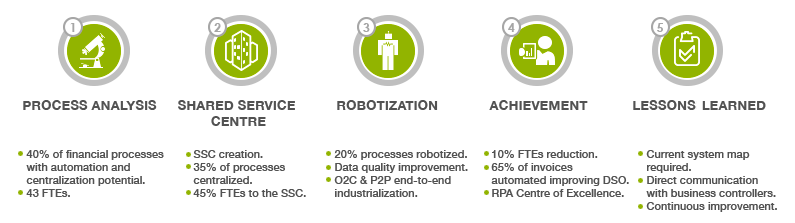

A leading global automotive company experiencing bad working capital performance on DSO and high cost to serve.

The manual and highly distributed execution of the accounts receivable and treasury process across production plants, generated lack of control, limited standardization and poor response times on month closing activities.

On an industry, where clients are strong global corporations that demand highest and predictable service levels, the heterogeneous model generated diversity on incidences resolution and disparity on client experience/service, depending which was the serving plant.

4. Talent management

A leading financial services company facing finance staff turnover up to 40%.

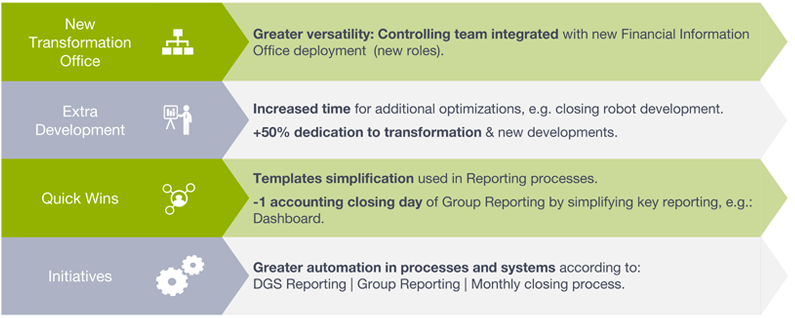

We helped the finance reporting team to improve service, instill new culture and retain key young talent.

5. Business & financial performance analysis

Partnering with a national railway champion to improve reporting and analytical capabilities.

This company faced limited ability to obtain analytical P&L in real time and high time consumption in reporting generation due to manual intervention.

A limited functional coverage of the available IT tools, and a complex landscape of sources of information, led this company to support the decision making process with excel.

- New analytical model to enable performance analysis by business unit and in line with contractual agreements and business model that this railway company has with its customers.

- Central data repository to ensure traceability and access to historical data.

- Reporting self-consumption through a Business Intelligence user-friendly tool to foster Controllers autonomy and ability to model business scenarios real-time.